The Monetary Policy Committee (MPC) announced today that the prime lending rate will remain at 10% and the repo rate at 6.5%. This follows from a period of wins and losses for the South African economy. CPI slowed to 4,1% in September from 4,3% in August. However, Moody’s also gave South Africa a negative outlook for its investment grading and lowered its economic growth outlook for the country from 1.5% to 1% for 2020.

According to Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett, the MPC acted in such a way as to contain inflation against a backdrop of potential threats, such as the volatility of the exchange rate and the ongoing instability of SEOs such as Eskom.

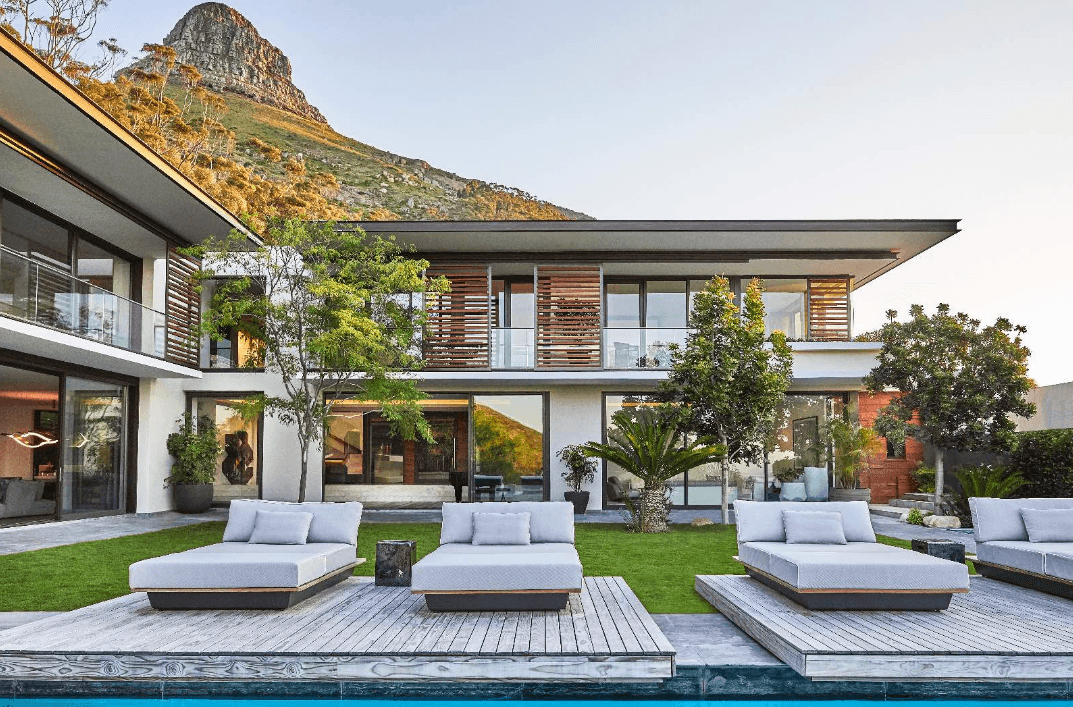

That being said, Goslett remains hopeful that the South African market will strengthen over time and prove itself to be a worthy investment market. “The South African real estate market still offers great value, especially for foreign buyers. Currently, many suburbs within South Africa are experiencing negative house price growth in real terms. But, market conditions are set to improve in the medium- to long-term, which means that those who purchase property as a long-term investment now stand to see good returns when it later becomes time to sell,” he explains.

Consequently, Goslett encourages South Africans to make the most of the sturdy interest rate by entering the market before house prices fully recover. “The way to help our economy grow is to invest locally. Rather than investing your cash in foreign retailers and offshore markets, plough your money back into the local economy by purchasing within the local property market. Then, set your roots down and get stuck into your local community by buying your groceries at the supermarket at the end of your road, hiring the local garden service, and visiting your neighbour’s hairdressing salon. While we might not be able to do anything about the policy decisions made by the MPC or other governing bodies, we can make a difference to our economy through our everyday actions. Together, these tiny contributions can help restore the local economy,” Goslett concludes.