Interest rates continue to climb following the latest announcement by the Monetary Policy Committee (MPC). The repo rate jumps by 25 basis points to 4.25%, leaving the prime lending rate at 7.75%.

This comes as no surprise to Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett, who had predicted that interest rates would climb in response to rising inflation and the global instability surrounding the Russia - Ukraine conflict.

“Sadly, South Africans will have to tighten their belts over the next few months. Rising fuel and food costs, as well as higher debt repayments resulting from the latest interest rate hike, will undoubtedly put pressure on household budgets,” he explains.

However, according to Goslett, it is not all bad news for the outlook of the country. “South Africa could be posed for growth if it positions itself well to fill the gaps in the global supply/demand chain. Exports already increased by 8,5% in the fourth quarter of 2021 and this stands to increase further in 2022 if the correct opportunities are seized.”

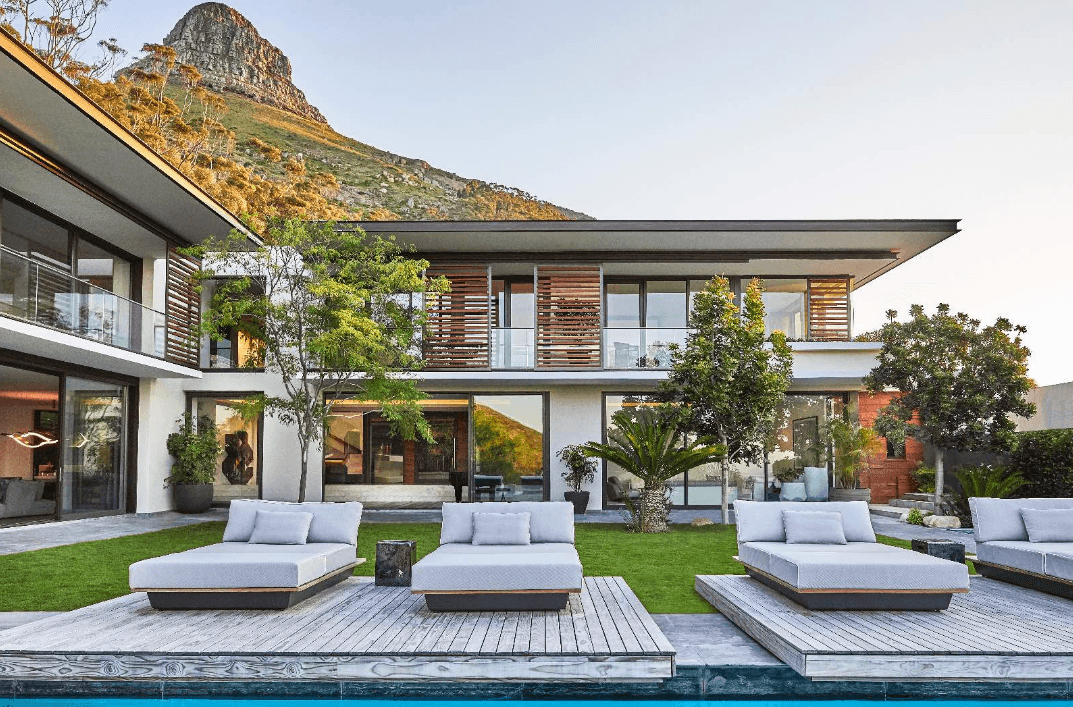

“The South African housing market also poses an appealing option for foreign investors who wish to diversify their portfolios to limit risk in an increasingly risky global economy,” he adds. For foreign investors, Goslett explains that the South African real estate market offers incredible value for money, especially within the luxury markets. “It would be beneficial to South Africans if more foreigners invest in the local real estate market as this would plough money back into the local economy and help stimulate growth in all related industries at a time when our country needs it most,” Goslett remarks.

While the interest rate hike will mean lower spending power for most local households, Goslett hopes that it will encourage South Africans to pay off debts as quickly as possible. “The amount of personal debt (in the form of car loans, shopping accounts, and credit card facilities) that South Africans carry is high. Carrying less debt will allow more South Africans the financial flexibility to seize investment opportunities as and when they arise. They can then take on better forms of debt, such as home finance, to invest in assets that appreciate over time. My hope is that this increase might bring with it a positive change in consumer behaviours and that this change may come to benefit the local housing market in the long term,” he concludes.