The Monetary Policy Committee (MPC) announced today that interest rates will remain stable at 8.25% (repo rate), leaving the prime lending rate at 11.75%. This comes as some much-needed relief as many debt holders are struggling to keep up with repayments, even at the current rates.

Given that inflation increased to 5,4% in September from 4,8% in August, it is understandable that interest rates would either have had to remain steady or possibly could have even increased to keep inflation in check. Regional Director and CEO of RE/MAX of Southern Africa, Adrian Goslett, says that the decision to keep them steady is a relief for the property market, as many homeowners are already starting to reach out for help to cope with the higher home loan repayments.

“According to our distressed property sales division, compared to the same period in 2022 to year-to-date November 2023, there has already been a 40% increase in the number of mandates received from the banks’ distressed property programs. What’s more, there has also been a 160% increase in the number of clients our agents have referred to their banks for assistance in signing up to their distressed programs,” says Goslett.

Given the current economic outlook, the hope is that interest rates will at least hold steady for the next few months, but Goslett warns that the possibility for further interest rate hikes are not completely off the cards. “My advice to consumers at this time is to manage their debt levels closely and to reach out for help if they notice that they are in over their heads,” he advises.

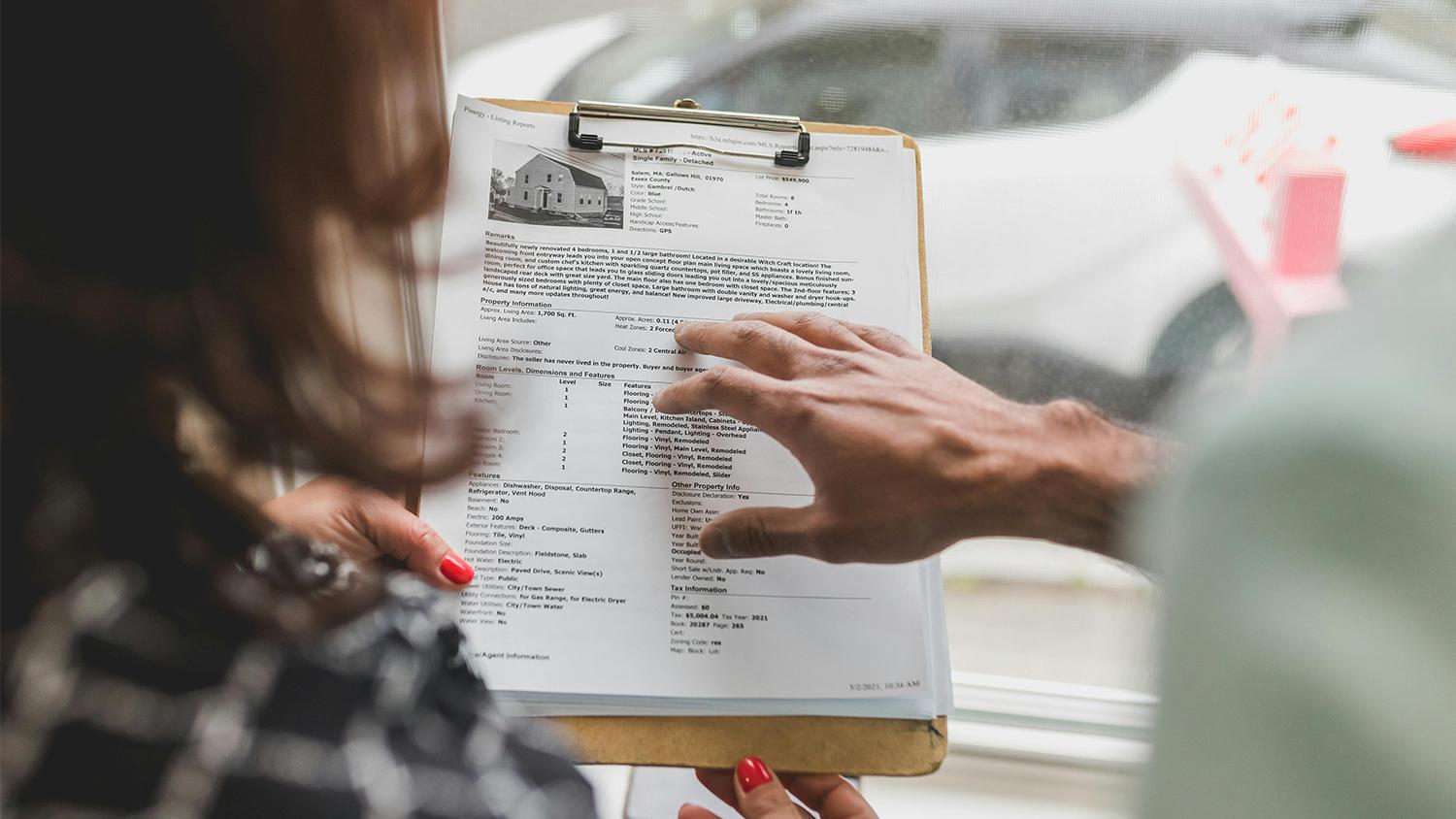

To real estate professionals, Goslett warns that despite the good news of interest rates remaining stable for now, the market is still likely to remain slow. “Affordability levels are a problem at the moment, which means that it will still be challenging to find qualified buyers who are willing to purchase within the current market conditions,” he notes.

Despite this, Goslett mentions that a well-priced home marketed by the right real estate professional will still sell timeously within this market. “Real estate professionals will just need to work closely with sellers to manage expectations and to help them set realistic asking prices,” he concludes.

For more real estate news or to enlist the help of a reliable real estate professional from the largest real estate brand in Southern Africa, visit www.remax.co.za.